T-Bank Cash Compass

Product Designer – Travel & Finance

Challenge

Sanctions left Russian travelers stranded abroad with limited and unreliable ATM access. Key issues found through research:

34% struggled to locate working ATMs.

21% were confused about card compatibility.

Over 60% turned to risky, unregulated P2P exchanges.

The Problem:

Travelers faced both a technical and emotional crisis—a high-stakes situation where every minute and every penny counted, compounded by a lack of trust in traditional banking systems.

User Insights

Three personas emerged:

Anna, 28 – The Solo Adventurer: “My card failed at three ATMs. I was forced to rely on shady exchanges. I needed a safe, immediate alternative.”

Dmitry, 42 – The Business Traveler: “I lost 45 minutes on ATM hunts, which meant missed business opportunities.”

Irina, 68 – The Cautious Retiree: “I almost fell victim to a scam at a bazaar. I needed a trustworthy, simple solution.”

Jobs to Be Done

By framing user needs as “jobs” that travelers hire T-Bank Cash Compass to do, we ensured our solution targeted the right pain points:

Locate Verified ATMs in Seconds Job: When I need cash immediately, I want a live map of working ATMs so I don’t waste time.

Avoid Hidden Fees Job: When I’m about to withdraw, I want a clear breakdown of all charges so I never face surprises.

Secure P2P Exchanges Job: When informal channels feel risky, I want an escrow-backed, partner-verified exchange to stay safe.

Navigate New Cities Confidently Job: When I’m in an unfamiliar place, I want community-rated tips and live updates to guide my choices.

Maximize Productivity Job: When I’m on a tight schedule, I want “Fast Cash” filters that surface the quickest, most convenient ATMs near me.

Benchmarking Snapshot

We dove into the travel-cash playbooks of leading challengers (Revolut, Monzo, N26, Wise, Curve) and found they all lean on live ATM maps, built-in free-withdrawal limits, and clear fee breakdowns. We loved N26’s barcode-based Cash26 trick, Curve’s zero-fee plus cashback hook, and Wise’s elegantly simple “two free withdrawals” promise. From this mix, we cherry-picked the best: a truly global, real-time ATM finder; transparent, on-demand fee insights; and a safe, escrow-backed P2P exchange—combining industry favorites into a single, standout experience.

Key Iterations

Real-world feedback fueled quick pivots: we dropped a bold “Find Cash” banner onto the home screen to kickstart ATM searches, overhauled filters so the lowest-fee machines float to the top, and trimmed away redundant steps from the P2P flow—slashing exchange times by nearly a third. Each tweak sharpened the app’s focus on speed, clarity, and trust, keeping Cash Compass lean, intuitive, and endlessly reliable.

Solution Highlights

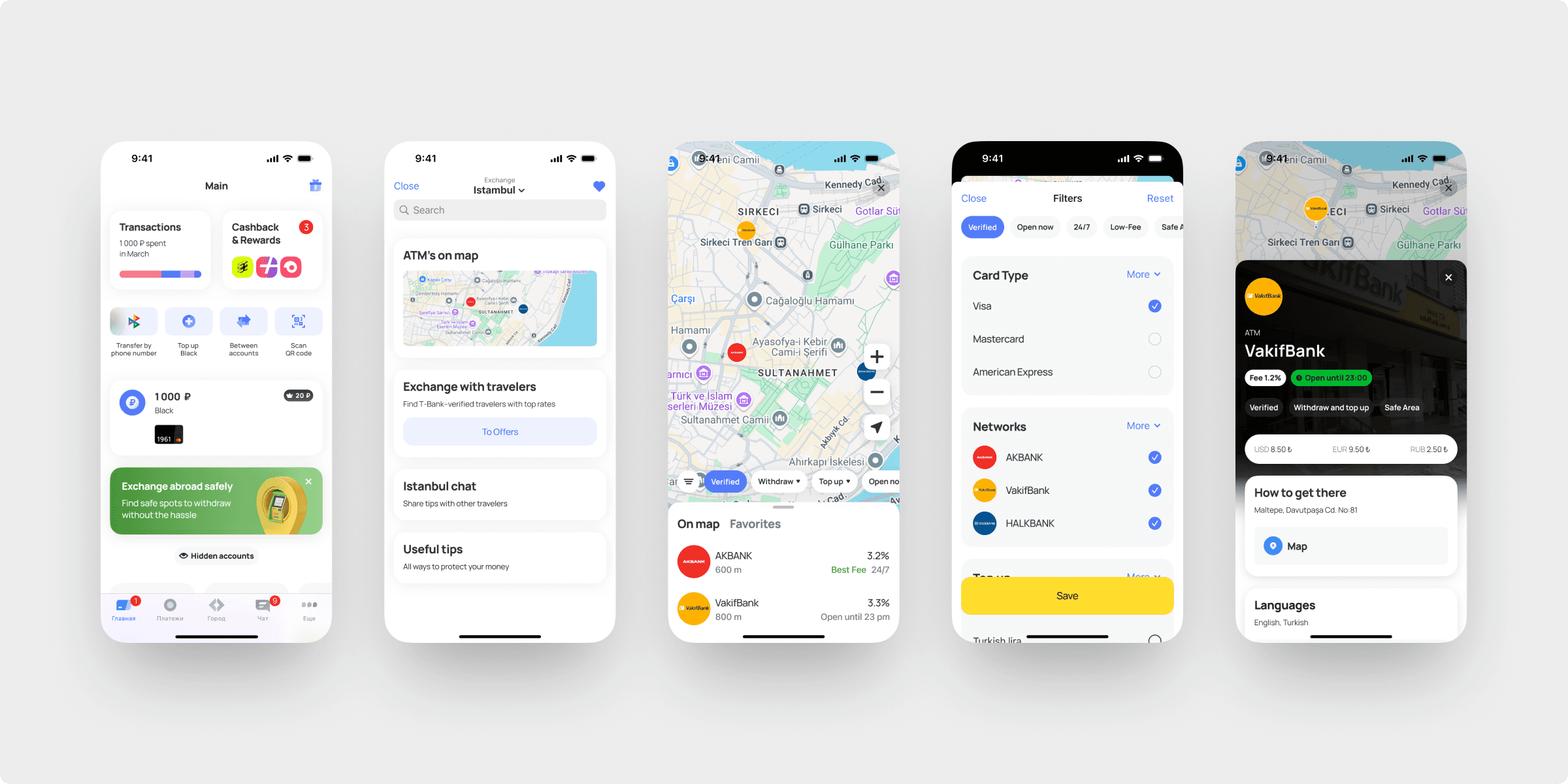

Dynamic ATM Finder

Real-Time Map: Crowdsourced data shows which ATMs are operational, with easy filters for fees and bank compatibility.

Impact:

Anna: Found a reliable ATM in 2 minutes.

Dmitry: Saved time in high-stakes business environments.

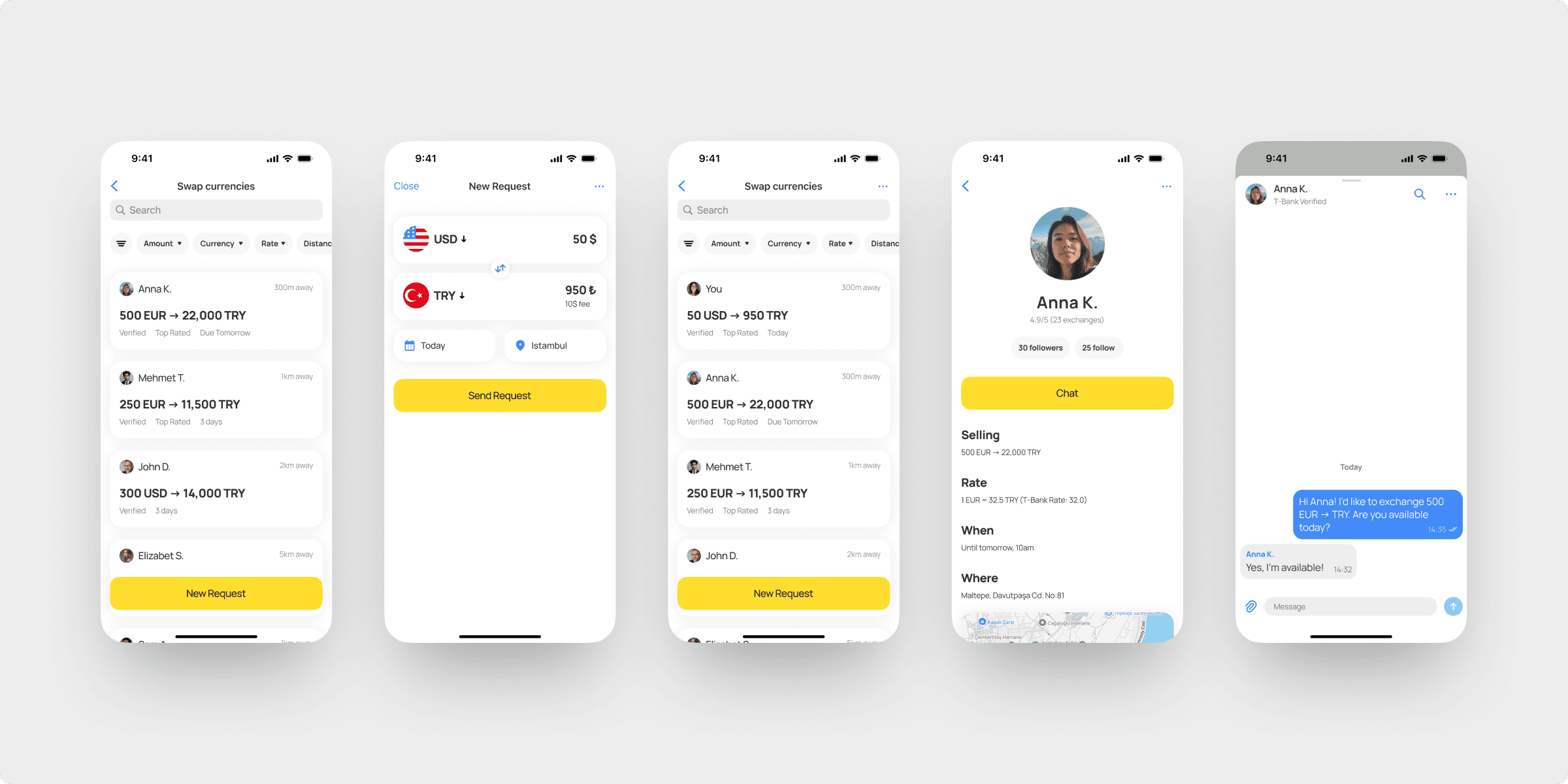

Regulated Peer-to-Peer Exchange

Secure P2P Board: Trades occur via escrow protection and mandatory verification, reducing risk compared to informal channels.

Impact:

Anna & Irina: Shifted from unsafe exchanges to reliable, T-Bank–backed transactions.

Results

Faster ATM Access: Reduced search times from up to 45 minutes down to just 2–5 minutes.

Enhanced Security: Fraud incidents dropped by 45% after implementing a secure, regulated P2P exchange.

Boosted User Satisfaction: User satisfaction soared from 50–60% to over 80%, as travelers felt more secure and well-informed.

Increased Engagement: App engagement surged by 20% during travel periods, reflecting the solution’s real-world impact.

Revenue Growth: Strategic partner ATM placements generated an additional €2M in annual revenue.

User Feedback:

“I thrived in Istanbul—feeling seen and secure.” – Anna

“T-Bank saved me precious minutes, directly impacting my business.” – Dmitry

“Clear and trusted: finally, a solution that works for me.” – Irina

Conclusion & Next Steps

By blending cutting-edge technology with a deep understanding of travelers’ needs, T-Bank turned a crisis into an opportunity. This project not only boosted user trust and safety but also significantly enhanced the company’s revenue streams.

Moving Forward:

Enhance AI for predictive fee models.

Expand global partnerships, including cash-at-checkout options.

Roll out the solution in new international markets.